India is the second most populous country in the world and has experienced demographic changes in the past 50 years by tripling of the population over the age of 60 years [1]. In a country like India, economic insecurity in elderly can be due to many reasons. Poverty is an important factor causing economic hardships in many families, and more so among elderly [2]. Elderly in poor families suffer from financial and economic hardship if they lose their family support [3].

It is important that the growing social and health requirements of elders have to be addressed optimally and comprehensively. The responsibility of taking care of the elderly’s health and wellbeing rests with the society, as they are no longer able to fend for themselves. This has thrown a spotlight on the importance of old-age income security schemes.

In order to overcome the financial insecurities faced by elderly, the NOAPS was introduced in India as a part of the National Social Assistance Program (NSAP) in the year 1995. It has been officially launched as Indira Gandhi National Old Age Pension Scheme (IGNOAPS) [3,4]. This scheme aimed at providing a safety net for India’s aging population in terms of social, economical and moral support by helping eligible elderly citizens with direct cash benefit. In India, social security being a concurrent responsibility, the monetary benefit to elderly people under IGNOAPS in various states ranges between Rs 200 to 1000 Rs with Centre’s share of Rs 200 in all the states [5].

Puducherry, a Union Territory in the southeastern coast of India, performs well in terms of socio-economic and health indicators and has Human Development in India ranking of sixth among all the states and Union Territories of India. In Puducherry the age criteria for receiving pension under this scheme has been revised from 60 to 55 years. Rs.1100 is given every month to eligible beneficiaries through Anganwadis and banks [6]. The transition to the banking system is not complete and there are issues faced by the elderly. This study aims to assess the utilization pattern of monetary benefits and satisfaction level among the beneficiaries and to explore the perception of the stakeholders regarding delivery of the pension scheme.

Materials and Methods

Study Design and Setting

This was a mixed method study including both qualitative and quantitative interview, which was carried out during January and February 2015. It was done in the service area of Urban Health Centre of a tertiary level teaching hospital in urban Puducherry, which caters a population of 9791 belonging to Kuruchikuppam, Vazhakulam, Vaithikuppam and Chinnayapuram. Fishing and working daily base is the major occupation of these people.

Study Population

Elderly beneficiaries belonging to service areas of JIUHC and received pension at least once in the last six months were included as study participants for the first phase of the study.

Sample Size and Sampling Technique

Based on satisfaction rates of 46% among beneficiaries [3] and absolute precision of 7%, sample size was estimated to be 195. Calculations were done using Openepi software, based on 95% confidence levels. Allowing for 5% non-response, final sample size was estimated to be 205. The list of beneficiaries of old age pension was collected from the Department of Women and Child Development, Puducherry, India. Proportionate stratified sampling method was adopted to know the number of samples to be taken from each ward. Simple random sampling based on system generated random numbers of 205 elderly from all four areas was done proportionate to the population of elderly beneficiaries in each ward. The number of subjects selected from each ward (Total population) is as follows: Kuruchikuppam (354)-53, Vazhakulam (628)-93, Vaithikuppam (46)-7 and Chinnayapuram (350)-52. The houses of the participants were located from the address list and in case of any difficulty the corresponding anganwadi worker was contacted.

Study Procedure

The proposal was approved by the scientific committee and Institute Ethics Committee. A structured questionnaire was developed to study the beneficiary satisfaction and utilization pattern of the monetary benefit received under the scheme. The variables included were socio-demographic details, details of pension received (duration, amount), beneficiary satisfaction (regularity, timeliness, mechanism, amount, autonomy) and utilization of pension amount. The questionnaire was translated into the local language and back translated to English. A pilot study was conducted among 10 elderly subjects in a different area and the questionnaire was pretested. After obtaining written informed consent the questionnaire was administered to the subjects.

In depth, interviews were conducted as part of the qualitative component to explore the perception of the stakeholders regarding delivery of the old age pension. Purposive sampling was adopted to choose the respondents and the key informants for the individual interviews. Informed consent was obtained from the participants and confidentiality of the data was assured. Interview was conducted based on the guide and responses were noted by the note taker. Appropriate probing was used wherever required. The duration of interview was limited to one hour. A total of 12 in depth interviews were conducted [among beneficiaries (4), family members (4) and Anganwadi workers (4)]. Interview guide was prepared to explore the stakeholders perception and details about pension approval, pension disbursement mechanism and benefits of the pension scheme. The interview guide was pretested in a few participants and probes were built in to enable the flow of discussion. The interviews were transcribed and translated in English. The compiled data was coded and content analysis was done. This enabled to generate themes of analysis which were further supplemented with quotes from the interviews. The analysed data was summarized into qualitative reports.

Statistical Analysis

Data were expressed as proportions mean and standard deviation. Data entry was done through Epidata. Association of socio-demographic variables with satisfaction levels were done by using Chi-square or Fishers-exact test. Analysis was carried out at 95% level of significance and p-value <0.05 was considered as significant. SPSS version 20 was used for statistical analysis.

Results

Socio-demographic Details and Health Conditions

The mean age of the study participants was 71 ±7.6 years. Around 49% of the study participants were aged between 65 to 74 years. Around 70% of study subjects were females and 62% were illiterate. Around 4% of the study participants were employed, 74.6% of the subjects belonged to class IV of Prasad’s scale, and 22.4% belonged to class III and V [Table/Fig-1]. Around 64% of study participants were living with their sons or daughters while 22% live with their spouse; 14% of the participants were living alone. Around 23% of participants were suffering from diabetes and 33% had hypertension. One fourth of the study population had at least one addiction behavior like tobacco-smoking, tobacco-chewing and alcohol.

Socio-demographic characteristics of study participants (n=205).

| Characteristics | Male | Female | Overall |

|---|

| N | % | N | % | N | % |

|---|

| Age |

| 55 to 64 years | 10 | 16.4 | 25 | 17.4 | 35 | 17.1 |

| 65 to 74years | 24 | 39.3 | 76 | 52.8 | 100 | 48.8 |

| 75 to 84years | 20 | 32.8 | 36 | 25.0 | 56 | 27.3 |

| 85 to 95years | 7 | 11.5 | 7 | 4.9 | 14 | 6.8 |

| Education |

| Illiterate | 36 | 59 | 92 | 63.9 | 128 | 62.4 |

| 1st to 5th | 20 | 32.8 | 41 | 28.5 | 61 | 29.8 |

| 6th to 8th | 2 | 3.3 | 8 | 5.6 | 10 | 4.9 |

| 9th to 10th | 2 | 3.3 | 2 | 1.4 | 4 | 2.0 |

| Higher secondary and above | 1 | 1.6 | 1 | 0.7 | 2 | 1.0 |

| Occupation |

| Unemployed | 59 | 96.7 | 138 | 95.8 | 197 | 96.1 |

| Employed | 2 | 3.3 | 6 | 4.2 | 8 | 3.9 |

| Socioeconomic class* |

| Class II (2557-5112 Rs) | 1 | 1.6 | 5 | 3.5 | 6 | 3 |

| Class III (1533-2556 Rs) | 3 | 5 | 20 | 13.9 | 23 | 11.2 |

| Class IV (767-1532 Rs) | 51 | 83.6 | 102 | 70.8 | 153 | 74.6 |

| Class V (<767 Rs) | 6 | 9.8 | 17 | 11.8 | 23 | 11.2 |

| Religion |

| Hindu | 52 | 85.2 | 122 | 84.7 | 174 | 84.9 |

| Christian | 7 | 11.5 | 21 | 14.6 | 28 | 13.7 |

| Muslim | 2 | 3.3 | 0 | 0 | 2 | 1.0 |

| Others | 0 | 0 | 1 | 0.7 | 1 | 0.5 |

| Caste |

| BC | 38 | 62.3 | 75 | 52.1 | 113 | 55.1 |

| MBC | 13 | 21.3 | 29 | 20.1 | 42 | 20.5 |

| SC/ST | 9 | 14.8 | 40 | 27.8 | 49 | 23.9 |

| Others | 1 | 1.6 | 0 | 0 | 1 | 0.5 |

| Total | 61 | 29.8 | 144 | 70.2 | 205 | 100 |

*Based on Prasad’s scale (2014).

Details of Old Age Pension Received by the Beneficiaries

Eligible beneficiaries more than 55 years of age received an amount of Rs 1100 as old age pension. Now the amount has been revised and all beneficiary were availing Rs.1500 as their monitory benefit [6]. Almost 42% subjects were receiving pension for the past 5-10 years, while 27% received for the past five years.

Regarding the process for pension application, the Anganwadi Workers (AWW) told that “At present Old Age Pensioner (OAP) application, is distributed by the Women and Child development department. We have to authorize that the person belongs to Below Poverty Line (BPL) family and is aged more than 55 for which he/ she should provide certificates such as Aadhar card, ration card, voter id, birth certificate, income certificate and bank pass book with an account in a specified bank. On an average, a person has to make two visits for the application; in case of any delay in certificate verification or mismatch or missing of certificate, additional two visits are required. We provide assistance for enrollment of pension and also sign the authorization.”

An elderly beneficiary replied that “Earlier, there was not much hassle involved, but now it’s a big process before we get enrolled. First, we have to visit the pension office to get the application form; then we have to visit the Tehsildar office to get his signature and then from the Anganwadi worker - that is a minimum of three visits and a lot of running around to do”. Another 60-year-old female added, “Getting signature from tehsildar is the biggest difficulty I faced - the tehsildar office is always busy and crowded. Process at the Anganwadi does not take much time. Though I don’t have my birth certificate, they accepted the voter id for enrolling.”

One respondent told that, “After the application is submitted to the office, it took a long time (six months) for us to receive the first pension amount. The family members added that “But nowadays, this process is completed in two to three months’ time. If there is any delay, it is mainly due to filling of form and getting signature from tehsildar office.”

Old Age Pension Received through Banks

Around 80% of participants availed pension from banks and the rest from Anganwadis. Around 55% received their pension during second week of every month, while 15% within the third week. The respondents felt that old people face difficulty in availing the pension from the bank, especially for those who are illiterate and living alone. Travelling to bank, which is far from their residential area, standing in a queue for a long time, filling challans, etc. were found to be the major difficulties faced by the beneficiaries.

A 65-year-old male said that “Earlier while availing pension from Anganwadi, there were no difficulties as it is located near our houses. There is no need of filling Challan - just keeping a fingerprint in the register was enough. Whereas now we need to travel to the bank which is at least 3 km away from our area by bus or auto; sometimes we spend nearly Rs. 150 for travel alone. Also, standing in allotted queues in the bank is very tiring as many times this special queue is longer when compared to others.”

However, there are some advantages to the new system in banks, as stated by another elderly male - “Now I can avail the pension after 7th of every month, whenever I want the money. I need not go to the Anganwadi on specific days!” He added that “The process of pension disbursement through banks can be made friendlier by having extra counters for elderly with a proper waiting facility and speedy clearance mechanism.”

Old Age Pension Received through Anganwadis

Around 20% beneficiaries continue to receive pension from the Anganwadis. All the respondents said that the pension was regularly distributed before the second week of each month. There were no incentives or bribes involved in the process or any other difficulties in receiving the entire amount.

One Anganwadi worker told, “After receiving the money from our head office, we inform the community members and they pass the information. Beneficiaries bring their pass book. For those who are bedridden, we visit their house and distribute their money. Pension amount will be distributed regularly from 7th to 15th of every month. In case of delay in receiving the pension amount from the office, we will explain the reason, and they accept the explanation. There is no hindrance in receiving the full amount.”

One elderly female told that “The Anganwadi worker informs us that the pension amount has been received at the office. We receive the amount from her and either sign the register or leave a fingerprint; then we spread the news to all elderly people living in the locality.” Her family member added “The pension amount is regularly distributed and there is no hindrance in receiving the full amount”.

Majority of the people responded that Anganwadi was their preferred mode of receiving pension (80%). One-third of the subjects felt that they would approach Anganwadi workers in case of grievances (29.8%). Around 39% responded that Anganwadi workers were the source of information regarding the pension scheme, while two thirds came to know from their neighbors.

Assistance for enrollment of pension is provided by Anganwadi teachers. “If I don’t understand the form at home, I take help from the Anganwadi worker. She helped me in filling the application form, checking the certificates and also guiding us to get the missing certificates.” Another respondent told that “Anganwadi teachers are very friendly, and we could receive pension nearby our homes at Anganwadis compared to banks.”

Utilization Pattern of the Pension Amount

Half of the subjects (49.3%) utilized the pension money for health needs (like medicines, visiting doctor); while one-third used it for travel; around 14% used it for their daily activities and social needs like visiting relatives attending social functions and ceremonies. Half of the subjects (54.6%) felt that they possess financial autonomy in utilization of pension amount. Around 85% subjects (n=175) told that they spend the entire pension amount received on their own. However, the remaining 15% gave some economic support towards their family; among them, the money was handled by their son (13%) or daughter and spouse (1.5%).

When asked about the autonomy of utilizing the pension, one AWW told that “Beneficiaries have some freedom in spending the money for their personal use. Elderly living in a joint family support the family by providing money. But in some families, the entire amount is taken by his/her son, leaving very little money with the elderly.” One elderly beneficiary told,“I have the freedom to spend the amount at my own wish. I can choose to give my money to my grandchildren or spend it on myself.”

Some of them give a part of their pension amount to their children and grandchildren. Another elderly female added “Due to poor economic status, I give part of my pension amount to my family; I am satisfied in giving my pension amount towards my son’s family and feel happy that I am able to help them in some way. I also feel satisfied when I spend some part of my pension money towards my grandchildren, as fulfilling their small needs brings happiness on their face.”

Beneficiary Satisfaction Regarding the Old Age Pension

Majority of participants (96%) were satisfied with the regularity in the distribution of pension and overall performance of the pension scheme (98%). Half of the beneficiaries (n=107, 52%) expressed dissatisfaction with the amount of pension received. Though satisfaction rates were higher in subjects aged <75 years and higher education status, this was not statistically significant [Table/Fig-2].

Association of socio-demographic characteristics and health conditions with beneficiary satisfaction regarding amount of pension received (n=205).

| Characteristics | Satisfied98 (47.8) | Dissatisfied107(52.2) | X2(df) | p-value |

|---|

| Age |

| <75 years | 66 (45.2) | 80 (54.8) | 1.37(1) | 0.24 |

| ≥75 years | 32 (54.2) | 27 (45.8) |

| Gender |

| Male | 28 (45.9) | 33 (54.1) | 0.126(1) | 0.72 |

| Female | 70 (48.6) | 74 (51.4) |

| Education |

| Illiterate | 67 (52.3) | 61 (47.7) | 2.8(1) | 0.09 |

| Literate | 31 (40.3) | 46 (59.7) |

| Occupation |

| Unemployed | 94 (47.7) | 103 (52.3) | 4.02(1) | 1.000* |

| Employed | 4 (50) | 4 (50) |

| Socio-Economic Class |

| Class I & II | 42 (42.4) | 57(57.6) | 1.38(1) | 0.28 |

| Class III | 41 (51.2) | 39 (48.8) |

| Health condition |

| Presence of chronic diseases | 76 (46.6) | 87 (53.4) | 0.44(1) | 0.50 |

| Normal | 22 (52.4) | 20 (47.6) |

*as two cells have count less than 5 Fisher’s Exact Test was used.

Regarding mechanism of delivery of old age pension, 93% beneficiaries availing pension from Anganwadi were satisfied compared to 58% availing from banks and this association was statistically significant (Chi-square 18.14, df=1, p<0.001) [Table/Fig-3].

Association of mode of pension delivery and beneficiary satisfaction (n=205).

| Mode of receiving pension | Satisfied133(64.9) | Dissatisfied72(35.1) | X2(df) | p-value |

|---|

| Anganwadi | 39 (92.9) | 3 (7.1) | 18.14(1) | <0.001 |

| Bank | 94 (57.7) | 69 (42.3) |

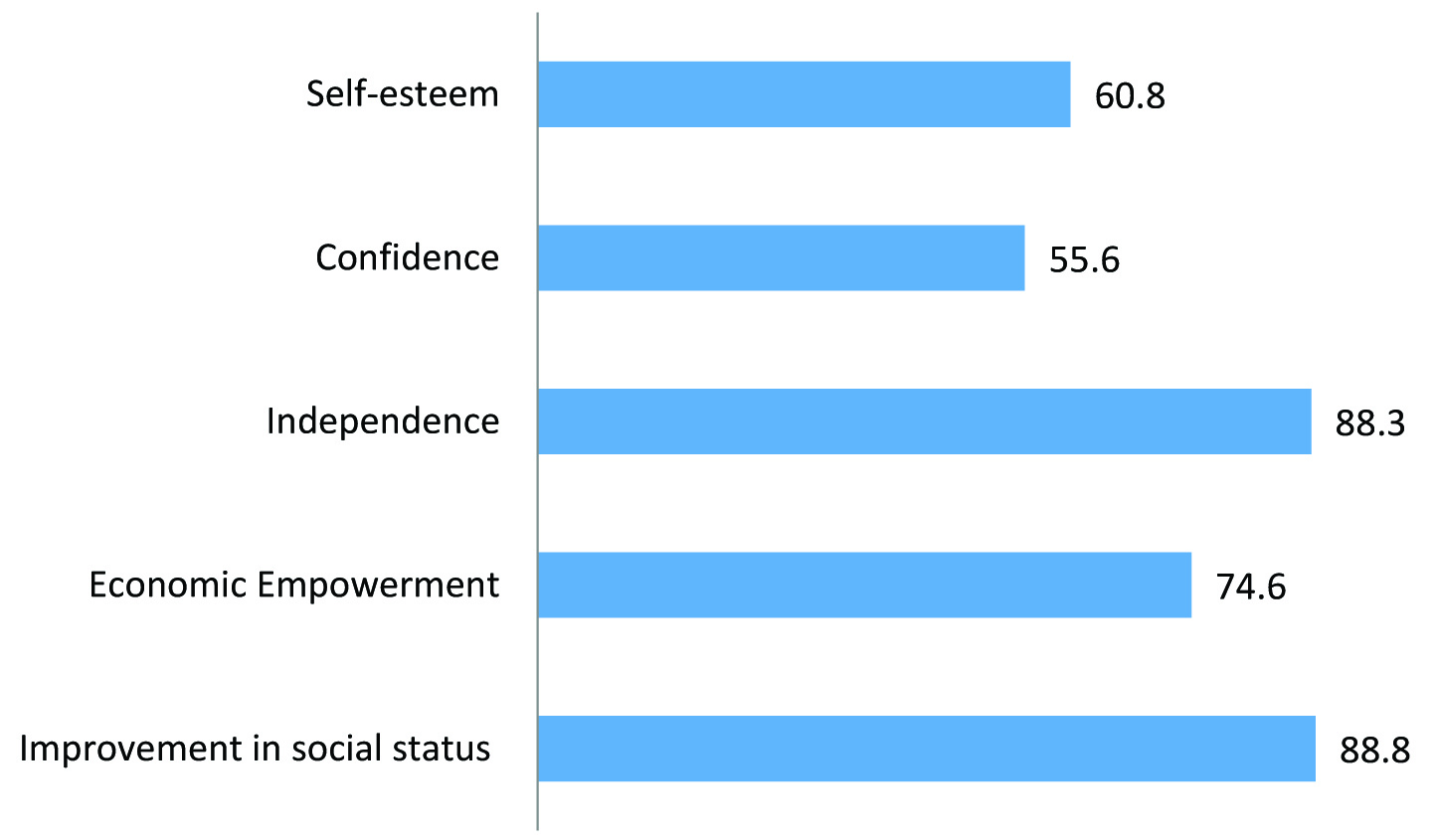

Majority of the subjects (88%) opined that they feel independent to take decisions of their daily living and there is improvement in their social status. Close to three-fourth felt that pension scheme has provided them economic empowerment. Nearly three-fifth (60%) of the subjects felt that old age pension has given them a feeling of self-esteem and more than half (55%) of them felt a renewed confidence [Table/Fig-4].

Perception regarding social and psychological benefits of receiving old age pension among the study participants (n=205).

* Figures are expressed in %

One family member mentioned “Pension gives economic support for the elderly to buy medicine or food.” One elderly male beneficiary told “I feel respectable about myself and feel that the Government cares for old people like me. The money gives me financial and moral support and helps me to be independent.”

Discussion

This study was done in an urban area of Pondicherry to get an insight into the beneficiary satisfaction, utilization pattern and perception of stakeholders regarding IGNOAPS. In our study, the mean age of the study participants was 71 years. The socio-demographic details were comparable to the general statistics in the region and also with an earlier study done in Puducherry [4]. Around 64% subjects were residing with their sons or daughters showing a high dependency of elderly on other family members. The high prevalence of chronic health conditions like diabetes and hypertension show the burden of diseases among elderly and the need for health care and social support.

In this study, 27.3% participants were receiving pension for the past 1-5 years. It was observed in the qualitative interviews that compared to earlier days, the process for pension application had been made more rigorous. Simplification of the pension application and approval process with further facilitation at the Tehsildar office would help the beneficiaries to avail the pension benefits with more ease. The number of documents being asked for verification and proof can also be reduced. The time period for the pension application and approval seems to be a long and tedious process. However, once approved there is no major delay in the sanction of pension or in the regularity of pension disbursement as stated by the respondents.

Majority of the beneficiaries (80%) were availing pension from the bank while remaining was receiving from the Anganwadi. Regarding time of receiving pension 57.1% responded that they received their pension in the second week. Earlier studies done in Puducherry shows that people availed pension money at home (money order) or Anganwadis. After the money order payment was stopped the disbursement of pension took place in Anganwadi and in bank [4].

In this study, 98% of beneficiaries were satisfied with the overall performance of the pension scheme. This is comparable with earlier studies which showed a positive impact on their livelihood [4]. Similar findings were observed in studies and evaluation reports on old age pension from other states [3,7,8].

Among the study subjects, 65% were satisfied regarding the mechanism of delivery of old age pension. The association between source of receiving pension (Anganwadis) and satisfaction level regarding mechanism of delivery (p<0.001) was statistically significant. With the introduction of bank-based delivery of pension, respondents felt the process to be more cumbersome to travel to the bank and to wait in a queue. This transition to banking system may be initially difficult for elderly as this may be their first opportunity at banks, but in the long run this may be helpful, as perceived by a few beneficiaries. Pension disbursement through banks and branches closer to their homes will help the elderly in reducing their burden of travelling long distance to avail their pension. Additional facilities like use of smart card or ATM card based money withdrawal can be explored so that these services are brought closer to their homes. However, the logistics regarding this measure needs to be piloted and tested for feasibility.

Majority of the people responded that Anganwadi was their preferred mode of receiving pension, and as mentioned in the In-depth interviews, few beneficiaries found it to be more convenient and less cumbersome. Pension delivery mechanism through banks has reduced the burden on the Anganwadi workers who are primarily involved in the functioning of Integrated Child Development Services (ICDS). However, facilitation of OAP and other Government schemes by the Anganwadi worker is a huge support for the community, and may be continued in future.

Half of the respondents (52%) were not satisfied with the amount received. However, Puducherry is one of the regions which provides high pension rate, with a state share of Rs 900 compared to other states with a state share of Rs 200 to Rs 500.

In this study, it was observed that majority of the study participants spent the entire pension amount received for their own use (health needs, travel, daily activities and social needs) while the remaining gave some economic support to their family. Half of them felt that they possess financial autonomy in planning their expenditure. Majority felt that receiving pension had given them economic empowerment, a sense of self-esteem and renewed confidence in life. These findings were corroborated through the qualitative component of the study. Further research can be done on utilization and satisfaction among rural elderly and its impact on the quality of life.

This was a community based mixed methods study where the qualitative interviews enable in-depth understanding of the topic in hand. Involvement of other stakeholders like family members and anganwadi workers gives additional perspectives regarding the pension scheme. Stratified random sampling of respondents and coverage of sample size enables representativeness in the community.

Limitation

However, there are few limitations. As this study evaluates beneficiaries from urban areas, implications of old age pension in rural areas could not be captured. Utilization pattern of the pension amount could not be captured distinctly as there was considerable overlap in the money spent. Interviews with the Programme officers of Department of Women and Child Development could not be carried out as proposed and so their perspectives could not be studied.

Conclusion

Financial assistance to the elderly empowers them and improves their social status, independence, self-esteem and overall quality of life. The satisfaction of close to half of the elderly population in this study with the pension amount questions the need to raise the pension amount. Further research is required to understand the implications in other domains like health needs. With increasing proportion of elderly in Indian population, it is important to study the effectiveness of such schemes so that corrective measures can be taken to facilitate its access to the disadvantaged section of the society.